Optimizing your strategic footprint

Add bookmarkEach year in October, IBM Global Business Services publishes its annual Global Location Trends Report. This year’s study revealed that the global market for foreign investment has been on a rollercoaster ride in recent years, with steady increases until the end of 2007, followed by significant declines in subsequent years, which persisted in 2009. Even if the number of greenfield and expansion projects remained almost stable – at 9,800 projects in 2009 – job creation by foreign investors dropped by almost 20% compared to the previous year and stood at 45% below the 2006 peak, in 2009.

The recent turbulence in the world economy has forced companies to rethink their business strategies and models, forming the basis for a fundamental change in corporate location decision-making. Indeed, the golden years from 2003 to 2006 were characterized by investments focused on expansion, to cater to growing or new markets, often resulting in ad-hoc additions to corporate operational footprints. This market-driven investment growth generated a geographic widening of investment activity, with penetration into emerging countries and regions around the world.

As the economic environment began to weaken at the end of 2007, and deteriorated significantly during 2008 and 2009, companies’ focus shifted from market access to cost containment and reduction. Operations and activities that could be reduced or combined without considerable cost or disruption were subject to consolidation, often in more mature, stable locations where companies were already operating, or in emerging low cost destinations which allowed for quick wins.

Starting in the second half of 2009, this tactical, short-term, corporate investment behavior gave way to a longer-term decision-making strategy. In order to stimulate growth, companies have been revisiting their global footprints and have launched into major strategic reviews of how to further optimize their location network and business models, so as to be better prepared for the future. In doing so, they are starting to capitalize on global opportunities for operational excellence and cost efficiency, while at the same time incorporating sufficient flexibility and dexterity into their operating models to address unexpected changes.

In this context, the shared services concept was given a boost, with investment in shared services activity translating to an increase of over 84,500 global jobs in 2009, compared to just below 78,000 in 2008. However, this remains considerably below the typical level of 100,000 jobs created in previous years. In parallel, the scope of the shared services model has further expanded to cover a wider variety of activities, increasingly including higher value-added activities such as Human Resources and decision support functions.

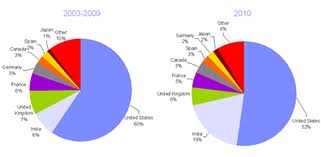

Figure 1 - General trends in announced shared services jobs by world region (2003-2009)

When investigating the geographical spread of recent shared services location decisions, Asia Pacific remains the prime destination for shared services employment, although its share in the global market has reduced from close to 50% across the period 2003 – 2008, to 43% in 2009, while Europe and Latin America respectively account for 22% and 15%. The most notable growth occurred in Africa, Oceania and the Middle East, although in absolute numbers their contribution to the globally announced shared services positions remains modest.

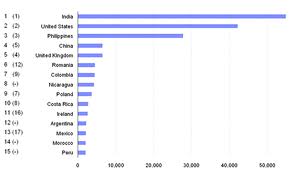

The ranking of prime destination countries for shared services establishments further confirms this geographical spread into emerging locations.

Figure 2 – Top ranking SSC destinations by estimated jobs (2009 compared to 2003-2008)

Asia Pacific

The largest shared services operations have traditionally been implemented in Asia, although in line with global investment trends, the average shared services project size has experienced a considerable reduction in the past two years.

One out of three shared services jobs announced in 2009 were based in the Philippines or India, whereas in past years (2003-2008), India alone accounted for over 40% of all new SSC-related jobs. As such, this demonstrates that the Philippines have taken over the lead from India in the global ranking of shared services destinations.

India, on the other hand, has developed into a mature shared services destination over the course of the past decade, with a strong emphasis on BPO type work. Next to the initial hotspots in India’s so-called Tier I cities for BPO & IT, investment is increasingly spreading into Tier 2 and 3 locations which have emerged as lower-cost alternatives, and are spread across the country. In the last three years, shared services jobs announced in India have been fairly stable, approximating 13,000 per year, whereas this figure averaged 50,000 in the years preceding the start of the economic downturn in 2007.

While the Philippines were initially attractive primarily for voice-related operations, the country has been successful in securing a much broader spectrum of shared services activities in recent years, covering both back and middle office functions (including F&A, HR, business & technical analysis, and SCM).

After its success with manufacturing, China is also increasingly gaining ground as a services destination, currently occupying the third rank in Asia-Pacific. The Chinese shared services market to date is strongly dominated by centers serving Greater China, although this is slowly expanding to also include a mix of non-voice BPO services covering a wider region. Diversification into more Tier 2 cities, inland, has only just recently started to materialize.

A surprise in the 2009 shared services job announcement ranking was Fiji, popping up as runner up. However, this is mainly due to the establishment of one large size center.

Sri Lanka has been busy positioning itself as an alternative to India, a strategy that has been bearing fruit in recent years. Other less explored countries such as Thailand, Vietnam, Indonesia and Pakistan, are expected to increasingly enter into the picture, as well.

Despite their higher operating cost structures, Australia, Singapore and Malaysia ranked among the top 10 recipients of Asian-based shared services jobs in 2009. This illustrates that in the new economic environment, companies are building global corporate architectures that optimally balance their needs for market, resources, talent and cost, hence embracing opportunities offered by different locations as part of a more optimal strategic shared services footprint.

Europe

Until 2006, a majority of shared services jobs announced in Europe were concentrated in Western Europe, which accounted for close to 70% of the total European SSC jobs created in 2003, and 60% in 2004-2005. Since 2005, however, there has been a more equal split between jobs created in West Europe versus East Europe. The average center size has remained fairly consistent across the years, with the most labor intensive centers typically being established in locations offering cost-saving potential.

2009 marked the first time that an Eastern European destination emerged as the number one European shared services destination, when Poland took over from the UK, which has led this list since the shared services concept was brought to Europe in the 1990s. Trading places with Poland, the UK also dropped out of the global Top 5, as its SSC job creation numbers dropped from an average of 10,000, to 5,000 in 2008 and 4,000 in 2009.

Surprisingly, Ireland, which seemed to have lost some of its appeal for shared services investments in 2007 and 2008, has returned strongly in 2009, ranking third on the European list, which places it back in the global top 10.

Other traditionally strong Western European shared services locations include the Netherlands and Spain, although these have been facing stiff competition from Central, and increasingly Eastern, European alternatives, which still offer cost saving opportunities and have considerably improved their European language skills over recent years.

Next to Poland, Hungary, the Czech Republic and Romania top the list in Eastern Europe, although investors’ focus in recent years has been moving further South East, to contenders such as Bulgaria, Serbia and even Turkey, on the one hand; and to countries that could potentially also serve the Russian market, such as the Ukraine, the Baltics, and Russia itself, on the other hand.

Latin America

After Asia Pacific and Central & Eastern Europe, Latin America has started growing in importance as the next emerging market for back office operations. Costa Rica, Colombia, Chile and Brazil have already paved the way among the world’s top 20 "recipient" countries. This quartet of countries accounted for the largest numbers of job announcements in shared services in Latin America from 2003 to date.

Also in Latin America, investors’ location-decision-map has widened in recent years, to now include El Salvador, Mexico, Uruguay and Argentina. In large economies like Brazil, Mexico and Argentina, multiple cities have successfully emerged to position themselves as strong alternatives to the capital cities.

Africa & Middle East

In line with overall foreign investment trends in the last couple of years, Africa has shown exponential growth in investment for shared services. South Africa was a clear frontrunner in developing shared services on the African continent, and again positioned itself as a prime shared services destination in 2009. Recent trends, however, focus strongly on Northern African countries, such as Morocco, Egypt and Tunisia, which cater predominantly to French speaking markets.

An African focal point for smaller-size shared services investments in the last five years has been Mauritius, and there are potentially a number of other currently more immature African locations waiting to be discovered.

In the Middle East, Lebanon made its entrance into regional SSC rankings with several contact center project announcements in 2009.

North America

While throughout the period 2003 to 2009, Canada and the US succeeded in attracting similar headcounts in shared services, the number of projects announced in the US during that same period is about 40% higher, which indicates that Canada tends to attract slightly larger-scale centers.

Overall, average shared services size has reduced across the whole of North America since the economic downturn hit.

In 2009, Canada only secured a handful of shared services projects, dropping from its 2008 position of 6th place in the global shared services job ranking, to 16th in 2009. The US, on the other hand, managed to retain the 3rd place rank it gained in 2008.

When focusing in on states and provinces respectively, Ontario clearly outperforms all other regions, having attracted one out of five announced shared services jobs in the past seven years. Runners-up, which each account for 4-5% of SSC job creation, include Texas, Alberta, Ohio, Nova Scotia, New Brunswick, British Colombia and Kansas. The top 5 regions in 2009 were Texas, Ontario, Ohio, Virginia and North Carolina.

Where do Shared Services projects originate from

US-based companies have traditionally been the main generators of global, foreign direct investment, and remain in that dominant position, although the decline in investment activity since the recession has affected projects. Nevertheless, the US continued to represent close to 40% of publically announced shared services jobs in 2009.

It is interesting to note that the reduced share of mature markets such as the US, but also Western Europe and Japan, has been compensated by growth in emerging economies. This applies to India, which remained a key destination for SSC and BPO activity but also increased its contribution to shared services job creation overseas to 15% in 2009. As such, India became the second largest investor in shared services projects after the US. These shared services projects represent 45% of all jobs announced by Indian investors in 2009.

Other Asian companies, such as Chinese, Japanese, and Korean, have only recently started to move down the path of shared services and we see enormous potential for further growth of the industry from these markets.

Figure 3 – Top ranking origin countries for SSCs by estimated jobs (2003-2009)

Industry and main players

More than 70% of the shared-services-type jobs announced since 2003 stem from the business services and ICT sector, due to the large portion of BPO and Knowledge Process Outsourcing activities. Financial services companies account for another 10% of the shared services job announcements.

This is clearly illustrated when zooming in on the leading global players. Major investors in shared services activity, announcing multiple projects year-on-year, include large outsourcing players such as IBM, General Electric, Dell, Hewlett Packard, Convergys, and the likes. The top 15 ranking also includes Deutsche Telekom and HSBC.

Whereas historically, companies from business services, ICT and financial services sectors were the first to centralize activities into shared services, the concept now has spread across many industries, including public sector organizations, particularly in Anglo-Saxon markets.

Conclusion

The recent turbulent economic climate has challenged corporate operating models, with global footprint optimization at the core of this transformation. In this context, the concept of shared services remains very much up-to-date, allowing companies to take advantage of global markets, talent pools and cost efficiencies, for an ever-increasing scope of business functions and activities. To accommodate these dynamic needs, destinations in all corners of the world are becoming the playground for shared services.

Methodology

This article is based on analysis derived from IBM’s proprietary Global Investment Locations Database (GILD). GILD records investment project announcements around the world on an ongoing basis, allowing detailed analysis on global trends in corporate location decision making.

The GILD database is maintained by IBM-Plant Location International (IBM-PLI), a specialized services within IBM Global Business Services, Strategy & Transformation Consulting. IBM-PLI is a global market leader in providing advice to companies on their location strategies, covering all sectors and types of business functions. IBM-PLI has extensive expertise in global shared services network strategies, having advised on over 300 shared services establishments in the past decade.

For more information or a copy of the full report, contact IBM-Plant Location International (IBM-PLI)

Roel SPEE, Global Leader IBM-PLI, roel.spee@be.ibm.com

Patsy VAN HOVE, Senior Manager IBM-PLI, patsy.van.hove@be.ibm.com

www.ibm.com/gbs/pli

IBM's Global Location Trends report provides information on global location strategies. Some of the key findings from this year's report:

- Signs of recovery in investment evident during the course of 2009.

- While the overall number of jobs created globally from foreign investment in 2009 was 680,000 - a decline of approximately 20% compared to 2008 - the number of individual investment projects remained almost stable, at 9,800 projects in 2009 – just 1% below the total for 2008.

- This shows that the downturn in publicly announced investment plans came to an end during 2009 – an observation supported by the fact that the data also shows an increase in the number of projects in the second part of the year.

- The recovery in investment from the second half of 2009 onwards is driven by new corporate strategic considerations. Companies are seeking to restructure and optimize their global footprint after the crisis, and position themselves for growth in a more complex and uncertain environment. This is in marked contrast to the more tactical and short-term decisions made during the depths of the crisis.

- The US is now the top destination country, with growth in overall number of jobs created from 2008 to 2009.

- Similarly, several countries in Africa and Latin America are also gaining ground in absolute and relative terms.

- In contrast, China and India experienced significant declines, as did several countries in Eastern Europe.

- However, companies from BRIC countries, and India and China in particular, become more important sources of global investment.

- The corporate restructuring is particularly pronounced in services, with companies making greater use of SSCs. As a result, services investment increased in 2009.

- The Philippines have overtaken India as the world’s top destination for business support functions, such as SSCs.

-

New sectors and clusters are emerging as sources of investment, with renewable energy showing exceptional growth in recent years.

The full Global Location Trends report can be downloaded at www.ibm.com/gbs/pli.

Roel Spee is Global Leader of IBM-Plant Location International and has over 20 years of experience as a consultant advising corporate executives where to locate businesses around the world. He coordinates these services of IBM-PLI on a global basis working together with consultants and experts in North America, Europe and Asia-Pacific.

Patsy Van Hove is Manager of IBM-Plant Location International. During 11 years of experience in location advisory services, Patsy has been involved in a wide range of strategic location studies for major international clients, assessing locations worldwide. She has particularly gained expertise in advising corporate clients on where to establish shared services centers of all kinds, both in Europe & Asia Pacific. She has developed IBM’s SSC Monitor, which is a database tracking information globally on shared services in existence, currently containing over 1,200 centers worldwide. Since IBM-PLI has been growing its presence in AsiaPac in the past couple of years, Patsy has been coordinating the local PLI representatives in the various Asian hubs.