Captive Acquisitions by Service Providers – Who Benefits?

Add bookmark

A Captive Center buying spree

If you have had the sense that service providers have been on a captive – or shared services center – buying spree, you’re right. Everest Group has seen an increased interest in recent years among the service provider community to acquire captives. In fact, captive acquisition is increasingly a top priority for service providers seeking nonlinear growth.

So: Why all the interest – who benefits … and how?

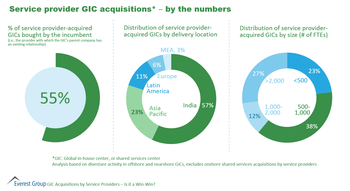

Our analysis of offshore and nearshore captive acquisitions by service providers* reveals a number of commonalties among these divestitures:

- More than 55% of service-provider-acquired captives are purchased by incumbent service providers; i.e., the service provider with which the captive's parent company already has an existing outsourcing relationship

- More than half of these acquisitions involve service centers in India, with another quarter in other parts of the APAC region

- Divestiture to a service provider is more common among mid-sized captives (500 to 1,000 FTEs) than any other size, at about 40% of all captive acquisitions by service providers

[click to enlarge]

But why?

The key motives for parent organizations to divest captives to service providers – and also service providers to acquire captives – can be classified into three broad categories: financial, operational, and strategic. And in most cases, two or all three of these factors come into play when a captive is sold to a service provider.

Reasons parent organizations divest their captives

- Financial: a captive is often viewed by its parent organization as a liquid asset, which it can relatively easily slice off and sell to generate cash and boost per-employee revenue figures

- Operational: As in so many other areas, parent organizations’ mantra for their captives is often "what have you done for me lately?" Parent organizations will often sell a captive that has either served its purpose or never lived up to expectations. The constant demands of captive evolution – staff, technology, physical and capital resources – can drive a parent organization to pass responsibility to a third party

- Strategic: After setting up and running a captive, some organizations determine they are best served by focusing on their core business operations and outsourcing non-core work, limiting their involvement in its management to SLA monitoring and governance

[eventpdf]

Reasons service providers acquire captives

- Financial: A captive acquisition is a high-return investment for a service provider with available cash, and it carries the added potential benefit of a resulting long-term outsourcing relationship between the service provider and the parent organization, helping the service provider to achieve non-linear, long-term growth

- Operational: In order to remain competitive, a service provider has to operate at a certain scale; acquisition of a captive is an effective way to scale up quickly and comparatively easily

- Strategic: Acquiring a captive is also a fairly quick way for a service provider to expand its delivery footprint, enabling access to new clients, as well as acquisition of expanded skill sets

For more details on acquisition of captives by service providers, including details on potential triggers for captive divestitures, and implications for both parent organizations and service providers, as well as detailed case studies, please see Everest Group’s full report, GIC Acquisitions by Service Providers – Is it a Win-Win?, or Adoption of Hybrid Sourcing in GICs – Driving Impact through GIC-Service Provider Collaboration, which addresses the benefits of captive and service provider partnerships.

*Our analysis specifically excludes onshore shared services acquisitions by service providers