UK Captives – Riding the Nearshoring Wave

Add bookmark

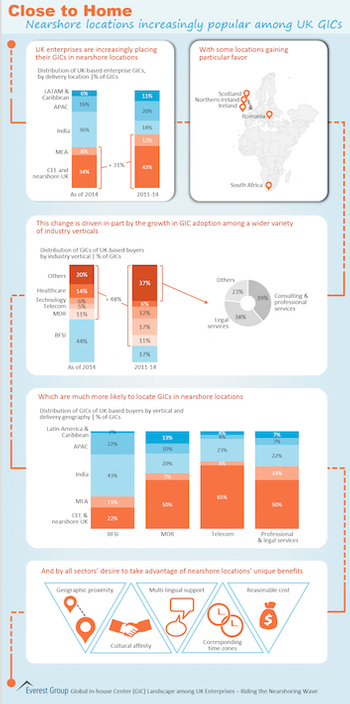

The United Kingdom is a leading parent geography for inhouse or captive (also known as Global Inhouse Center, or GIC) shared services adoption, second only to the US, with its total share of market growing steadily in recent years. As adoption grows, so, too, do location strategies; while offshore locations continue to dominate the UK-based inhouse or captive marketplace, nearshore activity has increased more than 30% in recent years, particularly in specific verticals.

New Adopters, New Location Strategies

While the banking / financial services / insurance (BFSI) vertical continues to dominate the UK shared services landscape, recent market growth has been fueled by emerging verticals, such as professional & legal services, telecom, and technology. And smaller enterprises are getting into the mix, as well, leading the way in new set-up activity in recent years.

These changes in adoption patterns have resulted in location strategy changes as well. Notably, captive set-up activity has increased in Central and Eastern Europe (CEE) and nearshore UK – these locations report almost three times more new captive setups than in India over the past few years.

A number of factors, many of which are vital to these emerging verticals, are driving the growth of captive set-ups in nearshore locations:

- Talent availability for sector-specific complex processes

- Workforce stability, with a low to medium attrition rate, versus mature offshore locations

- Overlapping time zones that facilitate real-time collaboration

- Proximity of service delivery to clients, which aids in customer personalization and innovation

- Cultural affinity with the parent geography

Nearshore Captive Characteristics

Nearshore captives’ operational characteristics vary significantly from those of their offshore counterparts:

- Nearshore captives are generally smaller in scale, with fewer than 500 FTEs, largely due to the more limited availability of talent and comparatively higher cost of operations

- Parent organizations primarily leverage nearshore geographies for business process work, whereas offshore locations’ work is a more balanced mix of business and IT service delivery

- While BFSI is the leading industry vertical in both near- and offshore captives, professional & legal services, MDR, and telecom also show significant activity in nearshore locations

For more detailed information on the UK captive nearshoring trend, see Everest Group’s report, Global In-house Center (GIC) Landscape among UK Enterprises – Riding the Nearshoring Wave.