The 4 Phases of a Finance Transformation Journey

Add bookmark

There is an old joke that goes something like, how do you eat an elephant? One bite at a time, of course! When the mission is big, it makes sense to break things down into bite size pieces to make progress, but one can never forget to keep your eye on the prize of the big picture to make sure you stay on track to accomplish your larger goal. Finance transformation is the elephant when it comes to strategic change. It is not something that can be accomplished in one sitting by including it in someone’s annual goals but rather a multi-year journey that needs to go through phases of work along the way. The good news is that transformation doesn’t take forever but can eventually be replaced with a program of continuous improvement once a different way of operating becomes the new normal. In my experience, the phases that a successful transformation needs to go through are strategize, plan, build, and run. These phases are interdependent and overlap, performing the necessary activities to turn an ambiguous/intangible idea (a transformed capability) into a program that creates a working finance-of-the-future function.

The strategize phase is intended to ground a finance transformation with a solid foundation. The first order of work is to assess the current state. Talking to people (inside and outside the department) as well as reviewing organization charts, any available numbers (Costs, KPIs, etc.), and the systems/data environment are a good way to get a holistic unbiased picture of reality.

If you have the time and resources, I recommend doing a 3rd party benchmarking to get everyone aligned to a consistent set of facts. In the end, stakeholders should agree to a case for change that can be articulated as a simple problem statement. Now that there is clarity around where finance is, there needs to be a future-state vision developed in the enterprise’s strategy context. Finance cannot have its own vision, mission or strategy that conflicts with that of the larger enterprise. As a supporting function, finance needs a vision that explicitly links and contributes to the greater goals of the enterprise. I use a strategy cascade technique which is simply putting enterprise and finance vision, mission, and strategy elements side-by-side so the connections are logically obvious. This shows how finance supports the achievement of enterprise. You should proceed to build out the future vision, mission, and guiding principles as they will be core artifacts throughout the transformation journey as you enlist more people to the cause and manage change.

The next activity in the strategize phase is to design a high-level operating model including scope, organization, and technology future-state. This is a representation of the combination of people, process, and technology that is needed in the future to achieve Finance’s stated mission and progress toward its vision. It is important to keep the description of the target operating model conceptual at this point. No names/departments in the organization design. Big blocks like shared services/GBS vs. retained functions, centralized vs. decentralized, hub-and-spoke model, etc. Jumping to detailed solution space too soon will cause transformation to devolve into political agendas, individual ambitions, and other distractions from the ultimate goal. Operating model scope should focus on which core processes finance will be responsible for and technology (with data considerations) aspects should focus on how finance is going to depend on ERP vs. business process management (BPM) specific SaaS solutions vs. RPA. It is very important to align with enterprise IT on the technology and data parts of the target operating model because they will need to come along on that part of the journey. Now that finance transformation is becoming more tangible, you can activate executive sponsorship and align internal/external stakeholders.

The strategize phase can take up to six months but it is well worth it. This is the go slow to go fast phase which will pay dividends down the road because the foundation set here allows transformation to proceed faster, build momentum, and hit fewer speed-bumps later on.

The plan phase turns finance transformation strategy into an executable plan. The inability to pivot from strategizing to preparation for execution is where many finance transformations fail. Strategy sets direction and specific projects make progress in the chosen direction.

Especially in the case of a finance transformation, a detailed, rigorous business case capturing all financial elements of a program (project costs, investments, annual savings, and ongoing expenses) must be developed and pass muster to move forward. Besides the value-story of the next-generation finance capability, a five-year projection of cash flows with analysis of the program’s net present value (NPV) and internal rate of return (IRR) is required at this point to unlock the resources that will be needed for execution as well as setting a baseline plan-of-record to ensure that promised financial benefits are achieved. Business case approval is a milestone of commitment that puts everyone on the hook for finance transformation success. Building the transformation roadmap seems harder than it really is. But where do you start? It takes two points to make a line. The same holds true for the beginnings of a roadmap. Whenever I don’t know where to begin, I draw a timeline. Today is the start date and the end date is when transformation needs to be complete. Although transformation is never really done, it will become the new way of working at a certain point and settle into more of a continuous improvement mode (hopefully sometime in year three).

Next, fill in major categories of work that are needed to get from here to there (people, process, technology, and data buckets are helpful to start). There is no limit to how many work areas to break down into, but I usually end up with about 4-5 “workstreams” at this point. Once you’ve built this skeleton of the roadmap, you can add tasks/activities (projects) to the work packages with milestones that signify completion of important pieces of work (especially those which have dependencies) along the way. At this point, you’ve created a draft roadmap that can be shared with others to get feedback and gain alignment. This is a scary moment because the draft was developed in isolation, and you can expect some critical feedback from subject matter experts who might know the work better than you. But remember, it’s easier to edit than create. A draft transformation roadmap gets the ball rolling. Management wisdom says, “it’s not the plan that’s important, it’s the planning.” So, who is going to drive all those projects on the roadmap? It’s time to add resources to finance transformation by building out a core enablement team.

Ideally, the core team should be small (~5 people) so transformation efforts can stay coordinated and agile. Also, since projects on the roadmap are of all types, you’ll need a core team of folks who are well respected, subject matter experts in their domains and can wear many hats. These people will likely be the leaders of your next generation operating model. It’s tempting to staff projects with those that are “available” but don’t fall into this trap. Creating the future is a job for your best, most capable people. In my experience, a small team of A players can accomplish much bigger things than a larger team of B and C level resources who have capacity and won’t necessarily be missed in the day-to-day of current finance operations.

The build phase is all about execution. Transformation is hard. Program management ensures progress and change management makes the new ways of working stick.

A program or transformation office (PMO/TMO) to effect project governance is a good thing to add at this point. A PMO provides oversight, coordination, and risk management so that things stay on track. Human resources, IT, and legal support will need to be added as well to assemble an extended core team to tackle the difficult work of people changes (role/organization), process improvement/standardization, and technology implementations. During the build phase, a planful, proactive, and two-way approach to communicating/managing change is critical to enable people to adapt. It is not enough to treat change management as a checklist of activities to perform, memo’s, town halls, training, etc. A systematic, data-based approach like the ADKAR method from Prosci is a good place to start. Since change management doesn’t follow a prescribed timeline like other projects, feedback data from employees is vital to confirm that transformation is on track from a change adoption perspective. The build phase is the meat and potatoes portion of transformation but simply hiring a bunch of project/change managers to execute without an aligned strategy and plan is not sufficient.

The run part of a finance transformation might seem like the end, but it is actually just the beginning of something else. Now that you’ve built your new house (operating model), you need to learn to live in it.

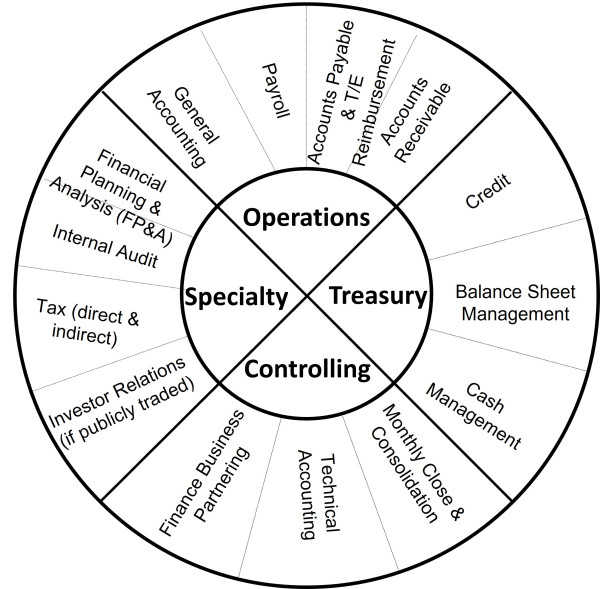

Transitioning from transformation mode to early-maturity steady-state requires structure. Implementing a core process approach to work, including creating the role of a Global Process Owner (GPO) and putting the right people in those roles is the best way to future-proof your next-generation finance capability. Finance core processes are the rails that technology and automation ride on, so leadership and responsibility for defining/continuously improving them needs to be clear. Finance core processes vary in character from operational (payables, receivables, payroll. Etc.) to strategic (treasury, FP&A, tax, etc.) and have slight variation depending on the specific organization but there isn’t much difference in finance jobs-to-be-done across enterprises. To govern and set the stage for continuous improvement, it is important to develop a metrics/KPI system to measure the health of finance core processes. Running a finance operating model using a Business Process Management (BPM) approach will reveal many opportunities to improve/optimize performance. To gather, prioritize, and act upon these opportunities, a continuous improvement (CI) program should be implemented as the run phase progesses. Although CI is part of everyone’s job and responsibilities, having a focal point and a formal CI program structure will provide expertise and create a culture of improvement which is embedded in the new finance operating model.

Transitioning from transformation mode to early-maturity steady-state requires structure. Implementing a core process approach to work, including creating the role of a Global Process Owner (GPO) and putting the right people in those roles is the best way to future-proof your next-generation finance capability. Finance core processes are the rails that technology and automation ride on, so leadership and responsibility for defining/continuously improving them needs to be clear. Finance core processes vary in character from operational (payables, receivables, payroll. Etc.) to strategic (treasury, FP&A, tax, etc.) and have slight variation depending on the specific organization but there isn’t much difference in finance jobs-to-be-done across enterprises. To govern and set the stage for continuous improvement, it is important to develop a metrics/KPI system to measure the health of finance core processes. Running a finance operating model using a Business Process Management (BPM) approach will reveal many opportunities to improve/optimize performance. To gather, prioritize, and act upon these opportunities, a continuous improvement (CI) program should be implemented as the run phase progesses. Although CI is part of everyone’s job and responsibilities, having a focal point and a formal CI program structure will provide expertise and create a culture of improvement which is embedded in the new finance operating model.

Finance transformation is a journey. It’s not as simple as hiring a bunch of project/change managers and executing a series of well-meaning but not-so-well-thought-out initiatives. This is why over 70% of transformation efforts fail (per McKinsey). But it’s not impossible and won’t take forever, either. If you break down the transformation journey into strategize, plan, build, and run phases, you can blend the right amount of strategy and execution to ensure a successful finance transformation journey. Good luck and safe travels!