Finance Transformation Starts with a Teardown to Core Processes

Add bookmark

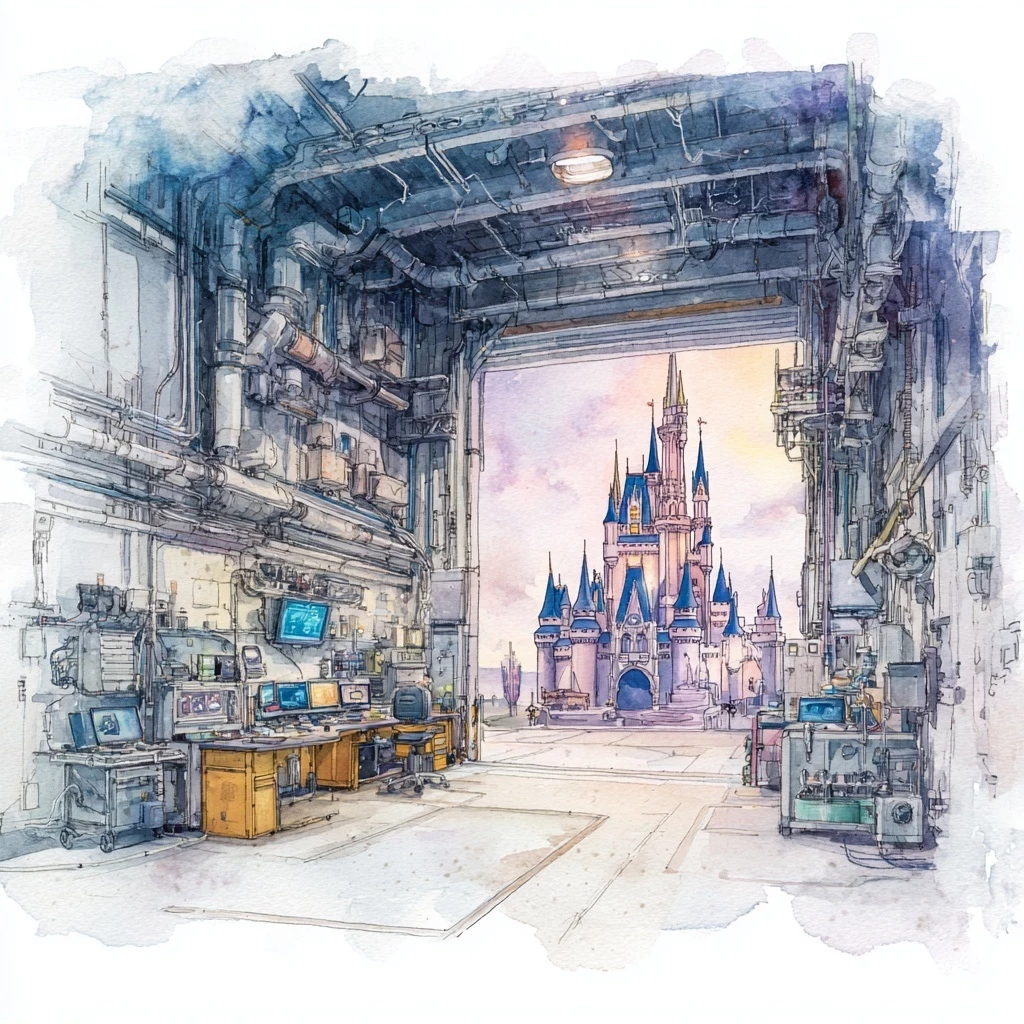

Like many people, my wife & I spent a lot of time confined to our house during the dog days of the covid pandemic in 2020/2021. Also, like many others, we decided to do some home improvement and remodeling. Well, the vision and scope for this project escalated quickly. It turned into a complete transformation of our first floor. New kitchen, new great room, new floors, appliances, lighting, etc. Achieving the desired future state required a complete teardown (including knocking out walls) to accomplish. It was messy, inconvenient and took longer than expected but I’m glad that we did it. The new design is open, modern and should meet our needs for years to come.

The experience is not unlike transforming a Finance function to meet the needs of the enterprise going forward. You need to tear it down to its basic building blocks and build it up from there. For a house, that means demolition work to get down to the two-by-four studs. For a Finance function, the basic framework is made up of the core processes that are performed on behalf of the enterprise.

Because each organization is unique, finance functions are not exactly the same but at the core process level, there isn’t much difference in the finance jobs-to-be-done to support the enterprise. I refer to the four core process areas as: finance operations, treasury, controlling, and specialty finance. Finance transformation often deals with finance operations first through pursuing an outsourcing, finance shared services (FSS), or global business services (GBS) model. This is a good place to start as this operating model helps Finance develop knowledge and proficiency in process thinking, ownership, metrics, governance. These concepts can then be applied to the retained process areas to transform the non-shared services finance activities and by getting the firefighting of finance operations out of scope and out of the way. Imagine the kinds of value that controlling and FP&A can add when the period close and consolidation is a non-event?

Finance operations core processes can be thought of as sub-functions to execute standard, repeatable, high-volume activities on behalf of the enterprise. The historical legacy of Finance is general accounting (e.g., journal entries, account reconciliations, etc.). When thought of as an end-to-end process, general accounting is integral to the record-to-report cycle (sometimes referred to as account-to-report/ATR). Handling the accounting tasks from recording transactions to close, RTR can make a standard, repeatable periodic close and high-quality book of accounts a given, not the result of a heroic effort of the whole department. Payroll is the creation of compensation payouts to employees and is often the responsibility of Finance (sometimes HR has it). Whether its periodicity is weekly, bi-weekly, or monthly, payroll fits the finance operations’ characteristic of a high volume, repeatable process that can be standardized to achieve greater efficiency and effectiveness. The accounts payable (A/P) process is responsible for payment to vendors for goods & services purchased in the enterprise. When integrated with upstream procurement activities, it can become an end-to-end purchase-to-pay process (PTP). Some GBS organizations take it even one step further, by integrating strategic sourcing and vendor management PTP becomes source-to-pay (STP). The accounts receivable (A/R) process encompasses the collection and application of cash from the enterprise’s customers and resolving any payment disputes. When integrated with commercial operations and fulfillment, A/R becomes order-to-cash (OTC). The analogous end-to-end process for a service business is known as quote-to-cash. Good GBS operating models are created by building appropriate technologies and organizational roles/structure on top of finance operations core processes and continuously improved to produce the best cost, quality, and service levels. Leadership of finance operations usually takes the form of a VP - Finance Shared Services or VP – GBS, reporting to the CFO or COO. Global process owners (GPO’s) should be in place for all finance operations core processes under management.

Treasury operations are responsible for the managementof an enterprise's holdings, with the goal of managing liquidity and mitigating operational, financial, and reputational risk. Core processes include credit risk management policy & operational oversight, balance sheet management, and cash, banking, liquidity & debt management. Treasury can take advantage of a finance shared services/GBS capability by internally outsourcing some of the higher volume, rules-based activities under its purview (e.g., customer credit hold/review/master data) to become more efficient and focus more intently on their strategic, judgement-based mission of managing the enterprise’s holdings. The titular leader is usually the Corporate Treasurer, and they should explicitly assign core process ownership among senior Treasury staff.

Controlling (or Accounting and Control) is the process area of finance responsible for corporate accounting and finance activities within an enterprise. This includes business unit and function support from a financial perspective, period closing, consolidation and financial statement issuance, and technical accounting expertise that sets policy, procedures, and attests to financial results. Implementing a finance shared services/GBS model greatly impacts the controlling area. Instead of the monthly heroic battle to achieve period close and issue financials, FSS/GBS now manages much of the heavy lifting in general accounting/close activities, allowing controlling to focus more on their technical accounting, attestation, and finance business-partnering duties. The leader of this process area usually has the title of Chief Accounting Officer or Corporate Controller and often is a Certified Public Accountant (US) or has another accounting credential for non-US (e.g., Chartered Accountant). The core process owners in controlling are not GPO’s per se but should be recognized experts and authorities in their respective domains.

The Specialty finance area core processes that are expertise-based and of strategic value to the enterprise. The application of expert judgement to unique challenges/situations characterizes these processes as knowledge work of the highest order. Financial planning & analysis (FP&A) leads budgeting, forecasting of financial plans for the company, builds, employs & maintains financial models, and analyzes & communicates insight into periodic financial results. Internal audit provides assurance & consulting activities to improve company operations. The internal audit core process is a systematic approach to evaluate/improve risk management, control & governance. The tax core process optimizes and ensures enterprise compliance with direct and indirect tax obligations. Investor relations is a finance core process for publicly-held enterprises that serves external stakeholders by providing relevant enterprise financial/operational information. Specialty finance process areas can use a finance shared services/GBS capability to offload some of their data management tasks such as compilation of budgets/forecasts (for FP&A), pulling data from operational systems (for Internal Audit), supporting tax authority audits, and providing systems administration for any SaaS tools that specialty finance employs. By relying more on FSS/GBS, specialty finance process owners can sharpen focus on activities that require their strategic expertise while internally outsourcing tasks that are better done elsewhere.

A significant home remodeling project starts by stripping down the space to the exposed beams so that a new design can be built upon the framework. Finance transformation is similar. Finance core process discovery and definition is the solid foundation upon which technologies and organizations can be overlaid. The people, process, and technology recipe of an operating model still holds but it must start with a finance organization understanding and defining their core processes. Only then can transformation create a next-generation finance operating model that will serve the enterprise well going into the future.